A mortgage used as security does not automatically transfer ownership, but failure to redeem within the statutory period extinguishes redemption rights. High Court at Mbale Rules

- Waboga David

- Dec 2, 2025

- 7 min read

FACTS

In January 2001, the Respondent (Francis Bosha Arapayanga) borrowed money from the Appellant (Chebet Francis Mamadi) and executed a written agreement (PEX.1) using his land (approximately 5–6 acres in Chebonet Village, Kapchorwa District) as security.

The agreement provided for a 10-month repayment period ending 9 October 2001, failing which the Appellant was expressly authorised to “sell or auction the said land without consultation” from the Respondent.

The Respondent failed to repay within the stipulated 10 months. The Appellant took possession of the land in October 2001 and peacefully occupied and utilised it for over 20 years (planting bananas, etc.).

In 2022 the Respondent re-entered the land, attempted to sell it, and was sued by the Appellant for trespass and declaration of ownership.

The Respondent counter-claimed, alleging the agreement was a mortgage (not a “debt agreement”), that it had been fraudulently altered, and that he had attempted to redeem in 2007, 2012, and 2022.

The trial Chief Magistrate (2024) found in favour of the Respondent, declared the Appellant a trespasser, cancelled the 2001 agreement, and awarded the Respondent UGX 12,000,000 in general damages.

The Appellant successfully appealed to the High Court.

ISSUES

Whether the Respondent’s counter-claim for redemption was barred by limitation.

Whether the Appellant was a trespasser.

Whether the trial court misapplied the law on mortgages (wrongly referring to the Mortgage Act 2009 instead of the repealed Mortgage Act Cap 229).

Whether the award of UGX 12 million in general damages was excessive.

Whether the trial court properly evaluated the evidence.

SUBMISSIONS

Appellant’s Submissions

The Respondent's right to redeem the land was extinguished by the 12-year limitation period prescribed by the Limitation Act, Cap 290, specifically Section 13. The cause of action accrued on January 9, 2001, or at the latest, when payment was rejected in 2007. The counter-claim, filed in 2022 (16 years later), was statute-barred. Cited Odyek Alex & Anor V. Gena Yokonani & 4 others and Kasoya and Another V. William Kaija and 3 others emphasizing the strict nature of the limitation statute. Also argued the trial magistrate misapplied the law by referring to the Mortgage Act of 2009 retrospectively for a 2001 transaction.

The Appellant lawfully possessed the land since 2001; therefore, he could not be a trespasser. The trial court failed to evaluate evidence and made unsupported findings.

Respondent’s Submissions

Limitation did not apply because he made repeated efforts to redeem the land (LC1, LC2, RDC) from 2007, 2012, and 2022. The purpose of a mortgage is always security, and the agreement was fraudulently altered by the Appellant. Cited Mutambulire V. Yozefu Kimera stating that a mortgage is always to work as security for a loan not a transfer.

The agreement was fraudulent and altered.

The Appellant unlawfully took over the land.

LEGAL REPRESENTATION

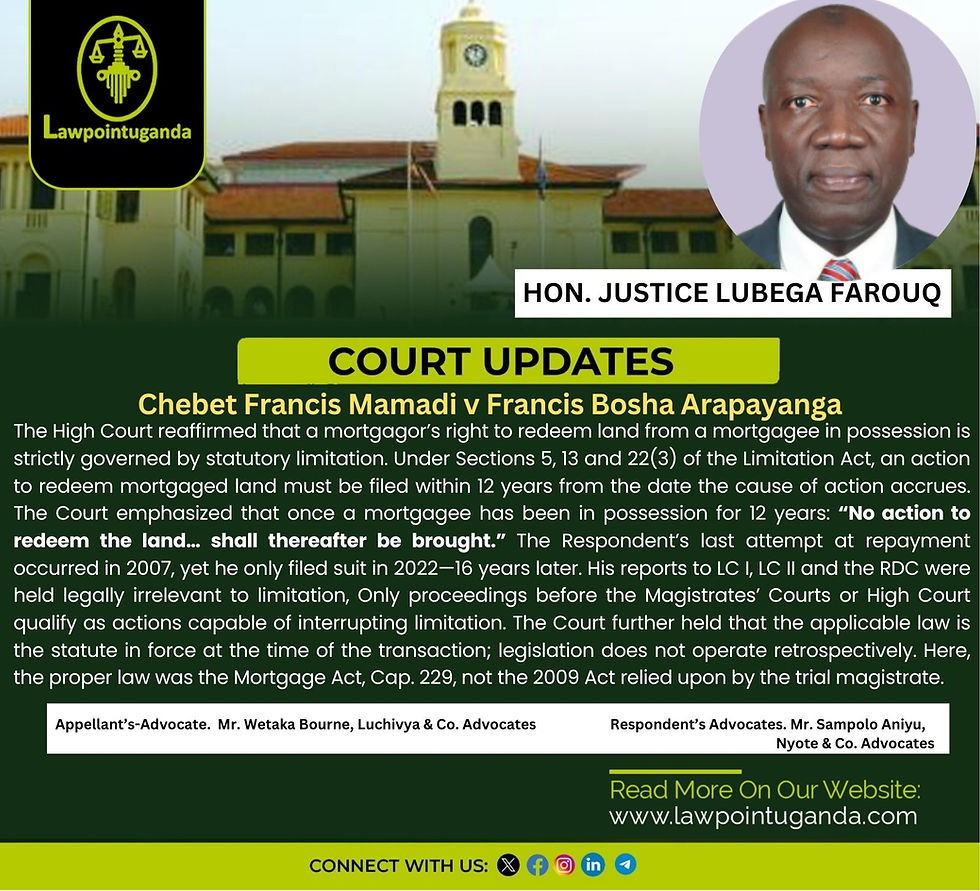

Appellant, Counsel Wetaka Bourne, Luchivya & Co. Advocates

Respondent, Counsel Sampolo Aniyu, Nyote & Co. Advocates

COURT’S FINDINGS

On Limitation and When Time Began to Run

The Court undertook a strict interpretation of Sections 5, 13 and 22(3) of the Limitation Act, Cap 290, and reaffirmed that actions for redemption of mortgaged land must be commenced within twelve (12) years from the date the cause of action accrues.

The evidence demonstrated that the Respondent last attempted to redeem the land in 2007, when the Appellant allegedly declined to receive the balance of the purchase/mortgage redemption money. Under Section 13 of the Limitation Act, this rejection constituted the point at which the right of action accrued.

The Court held:

“The above section read pari materia with section 13 means that the cause of action accrued to the Respondent in 2007 when the Appellant allegedly rejected to receive the money from him. From 2007 to 2022, when the Respondent filed the counter-claim, a period of 16 years had elapsed.”

The statutory period having lapsed, the Respondent’s right of redemption was extinguished by operation of law, and he could no longer maintain an action for redemption or challenge the Appellant’s possession:

“Having failed to institute a suit within the required 12 years, the Respondent extinguished his right of redemption.”

The Court further clarified that limitation extinguishes not only the remedy but the right itself in actions for recovery or redemption of land.

On the Effect of Reporting to Local Council Authorities

The Respondent argued that time should not run against him because he had lodged complaints with LC1, LC2, and the RDC. The Court rejected this argument unequivocally.

Referring to Section 1(a) and (c) of the Limitation Act, the Court emphasized that only proceedings commenced in a court of law can constitute an “action” capable of affecting limitation:

“Section 1(a) and (c) of the Limitation Act defines the term action to include proceedings in court and the term court to mean the High Court or a Magistrate’s Court. It follows therefore, that the Respondent ought to have instituted a suit in court.”

The Court held that:

“The mere fact that he reported the matter to the local council authorities did not stop time from running.”

Therefore, the Respondent’s administrative and local council complaints were legally ineffectual in interrupting or suspending the limitation period.

On Alleged Fraud and Alteration of the Agreement

The Respondent alleged that the agreement (PEX.1) had been altered and that his signature was forged or tampered with. The Court found the allegation unsubstantiated and unsupported by credible evidence.

After examining the document, the Court observed:

“In the view of this Court, that evidence was insufficient to establish fraud, as it appeared to be an afterthought… The Respondent ought to have challenged his signature on the agreement but he did not.”

The Court noted consistency in both signatures and handwriting:

“I have examined PEX.1 and observed consistency in the Respondent’s signature and in the handwriting of the author. There are no alterations whatsoever, contrary to the Respondent’s allegation.”

Applying Section 103 of the Evidence Act, the Court concluded that the Respondent failed to discharge the burden of proving fraud:

“It was therefore the duty of the Respondent to prove fraud as he alleged it, but failed.”

Fraud having failed, the agreement remained valid and enforceable.

On Misapplication of the Mortgage Act

The trial Chief Magistrate relied on the Mortgage Act of 2009 when analyzing the parties’ transaction, even though the agreement was executed in 2001.

The Court found this to be a clear error of law:

“The trial Chief Magistrate made reference to the Mortgage Act of 2009. This was erroneous since the law does not apply retrospectively.”

The applicable law was the Mortgage Act, Cap 229, which governed all mortgage transactions prior to 2009. The misapplication of the law contributed to the trial court’s erroneous conclusion.

On Trespass and Possession

Having found that the Respondent’s right of redemption was extinguished by limitation and that the Appellant lawfully took possession in 2001, the Court held that the Appellant’s long-standing occupation could not constitute trespass.

The Court stated:

“Having answered ground one in the affirmative, it follows therefore that the Appellant was and is not a trespasser on the suit land.”

The Court also noted that the Appellant had been in adverse possession for more than 20 years, reinforcing that his occupation was lawful and unchallengeable.

On General Damages

The trial magistrate had awarded UGX 12,000,000/= in general damages to the Respondent. Because the Respondent’s counter-claim failed and the foundation of the award was erroneous, the High Court set aside the damages award:

“The trial magistrate wrongly exercised his discretion when he awarded UGX 12,000,000.”

On Re-evaluation of Evidence

The Court held that the trial court failed in its duty to properly evaluate the evidence and wrongly applied the law, leading to an unjust decision:

“The trial court failed to evaluate the evidence and reached an erroneous decision which occasioned a miscarriage of justice to the Appellant.”

HOLDING

The Respondent’s counter-claim for redemption was statute-barred under Sections 5, 13, and 22(3) of the Limitation Act, Cap 290, having been filed 16 years after the cause of action accrued.

The Respondent’s right of redemption was extinguished, and he could not legally recover or challenge the Appellant’s possession of the land.

The Appellant was not a trespasser, having lawfully taken possession in 2001 and occupied the land for over 20 years.

The trial court erred by applying the Mortgage Act, 2009 instead of the Mortgage Act, Cap 229, which was the correct statute for the 2001 transaction.

The allegation of fraud in PEX.1 failed for lack of proof.

The award of UGX 12,000,000 in general damages to the Respondent was set aside.

The entire judgment and orders of the trial Chief Magistrate’s Court were vacated.

The appeal was allowed in its entirety, with costs awarded to the Appellant both in the High Court and in the court below.

KEY TAKEAWAYS

Strict 12-Year Limitation in Mortgage Matters

A mortgagor’s right of redemption against a mortgagee in possession expires after 12 years from the date the cause of action accrues (e.g., when the debt becomes due, possession is taken, or the right to redeem is denied). After 12 years, the right is extinguished under the Limitation Act.

Only Court Actions Stop Limitation Time

Reports made to LC I, LC II, or the RDC do not stop time from running. Only filing a suit in a Magistrate’s Court or the High Court constitutes an “action” capable of interrupting limitation.

Non-Retrospectivity of Statutes

Courts must apply the law in force at the time the transaction occurred. Applying a later statute, such as relying on the Mortgage Act, 2009 for a mortgage created in 2001, is legally improper.

Burden of Proving Fraud

Fraud must be specifically pleaded and strictly proved. Mere allegations, inconsistencies, or witness recollections are insufficient to meet the required standard.

Nature of a Mortgage

A mortgage used as security does not automatically transfer ownership to the mortgagee. However, once the statutory limitation period lapses, the mortgagor’s right to redeem is permanently lost.

Read the full case

.jpg)

Comments